The Private Debt Investment Marketplace

Connecting asset sellers with financing

Access to private debt origination

- – We facilitate direct negotiations for single-seller offers, and convert assets into investable notes.

- – The Tradeteq Investment Programme grants instant access to a diverse selection of instruments.

Discover Tradeteq investment opportunities

Tradeteq provides access to diversified private debt investment opportunities. Select individual asset sellers on the marketplace or discover the Tradeteq Investment Programme.

Single-seller

Access Individual Asset Sellers

- $3 billion issued notional as of January 3, 2024

- $230 million available for investment as of January 3, 2024

- Target yield: Various

Multi-seller

Tradeteq Investment Programme

- $75 million issued notional as of January 3, 2024

- $225 million available for investment as of January 3, 2024

- Target yield: SOFR + 3.5%

Marketplace Access

Showcase your company and grant investors access to attractive investment opportunities.

What do we offer?

Tradeteq streamlines single-seller negotiations and transforms assets into investable notes, while also offering immediate access to a diverse multi-seller notes.

How we support you

We support private debt such as trade finance, direct lending, and infrastructure debt.

How to apply

Complete the sign-up form

Transaction servicing

We support asset sellers in creating a complete note offering for presentation to investors.

Securitisation as a Service

Our Securitisation as a Service converts private debt assets into tradable securities through a specialised Luxembourg-based SPV. Enabling funding, risk management, and liquidity for originators while providing investor protection through asset ring-fencing. Integrated with our technology, this service ensures compliance and uses standardised, legally-vetted documentation. The result is a transparent, scalable, and cost-efficient securitisation solution.

Workflow automation

Seamless automation ensures efficient processing, allowing asset sellers and managers to focus on investment decisions without manual hindrance. Our technology is at the heart of the allocation process, matching assets based on the investment mandate's eligibility criteria.

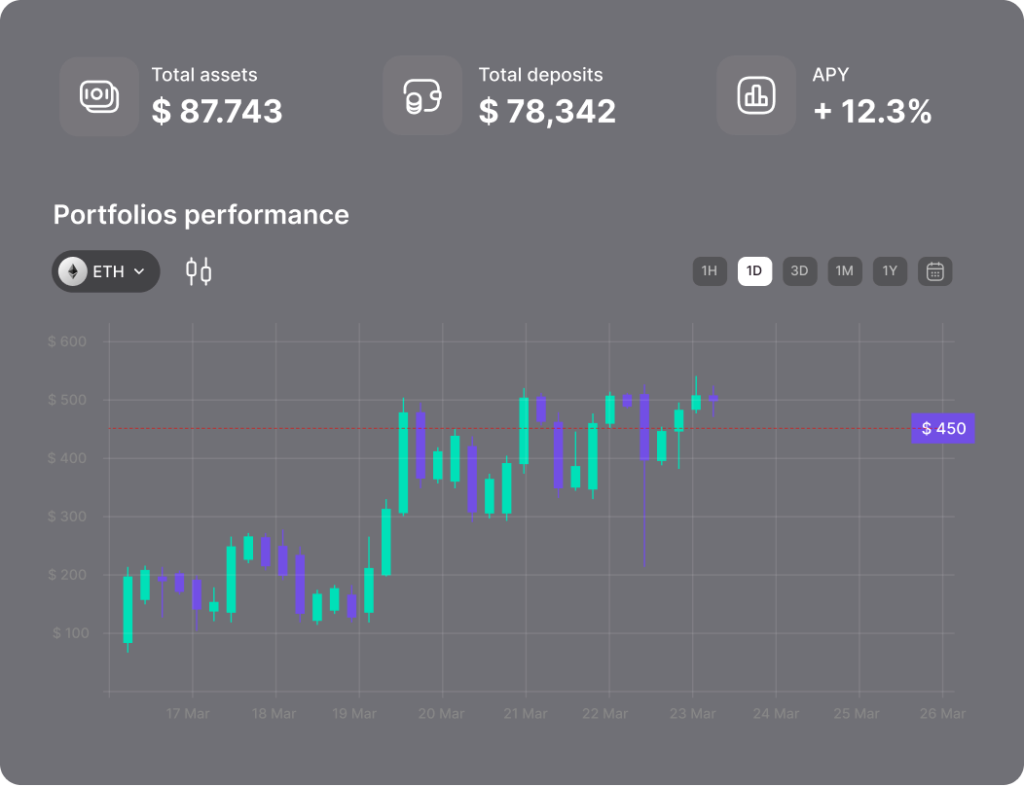

Real-time investor reporting

We provide comprehensive investor reports that cover everything from entire investment portfolios to specific trading books and counterparties. Our reports offer in-depth financial metrics such as aging and amortisation profiles, and customisable NAV calculations adjustable for risk. We can additionally provide specialised compliance reporting and offer all analytics through a user-friendly, cloud-based dashboard.

Instruments we support

Trade finance

Instruments funding the global flow of goods and provision of services.

Direct lending

Loans provided directly without banking intermediaries.

Infrastructure debt

Financing for large-scale public and private projects.

Consumer finance

Lending products for individual consumer needs.

Distressed debt

Instruments associated with financially-troubled companies and assets.

Real-estate debt

Loans backed by residential or commercial properties.

Real assets

Investments in tangible assets like properties or commodities.

Asset-based lending

Loans that are secured by a company's tangible assets, such as inventory or receivables.