The Private Debt Investment Marketplace

Connecting asset sellers with financing

Fast-tracking your readiness to engage investors

We efficiently transform assets into investable notes, streamline the due diligence process, and support seamless transactions, ensuring you’re primed and ready for investors.

Your journey to institutional investors

- Marketplace listing

- Due diligence

- Note offering

- Transaction servicing

Marketplace listing

Showcase your company and grant investors access to attractive investment opportunities.

Free currency exchange

transactions per month

Buy and sell digital currencies

domestically & internationally

unlimited spending and no

monthly maintenance fees.

Note offering

We support asset sellers in creating a complete note offering for presentation to investors.

Transaction structure

Overview of transaction structure and legal considerations.

Investment proposal

Creation of an investment proposal that is compatible with investor expectations.

Term-sheet

Define and revise draft note term-sheets for funders based on mandates.

SPV onboarding

KYC and AML by SPV service providers.

Instruments we support

Trade finance

Instruments funding the global flow of goods and provision of services.

Direct lending

Loans provided directly without banking intermediaries.

Infrastructure debt

Financing for large-scale public and private projects.

Consumer finance

Lending products for individual consumer needs.

Distressed debt

Instruments associated with financially-troubled companies and assets.

Real-estate debt

Loans backed by residential or commercial properties.

Real assets

Investments in tangible assets like properties or commodities.

Asset-based lending

Loans that are secured by a company's tangible assets, such as inventory or receivables.

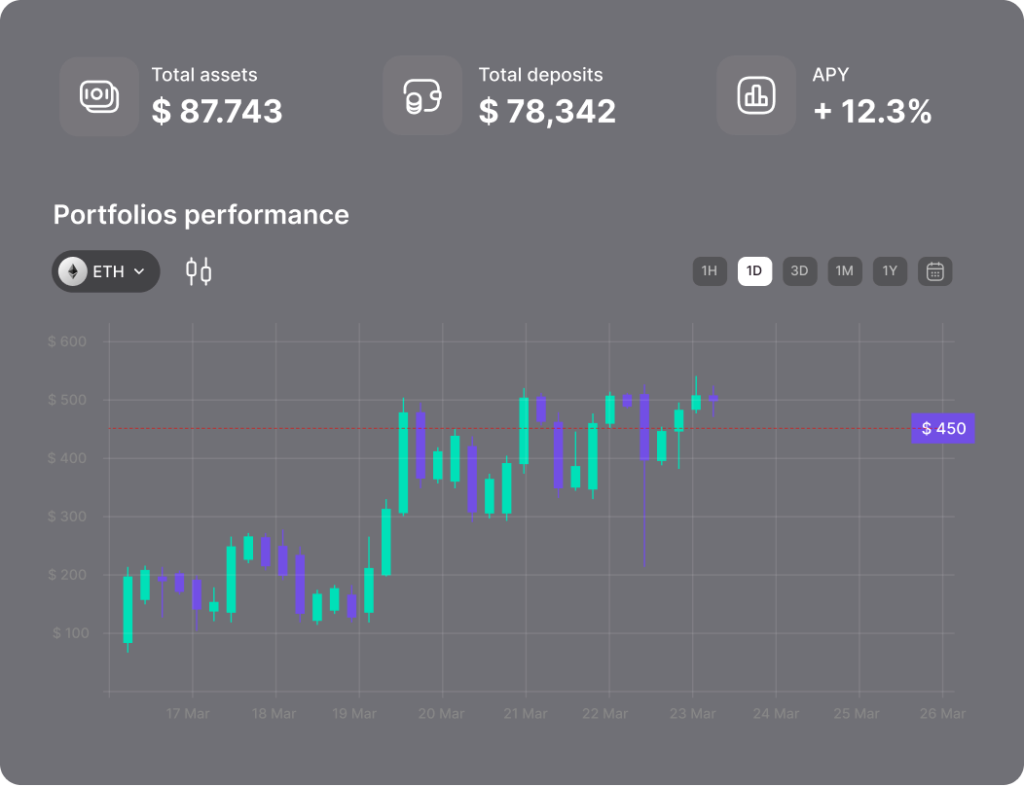

This platform supports multiple currencies

Moderna Invest allows users to store more than 1,400 cryptocurrencies, and it also provides options for people who want to buy, exchange, or stake digital assets directly from their wallets.

Unlike some of its competitors, Atomic Wallet doesn’t have the option of directly connecting your holdings to cold storage.